Surety Bonds

Construction Bonds, Quick, Simple and Competitive..

As a leading provider of Construction Bonds we can assist with any type of Bond for your contractual requirements, the most common form of Bond we are asked to place are:

Surety Bonds or Construction Bonds are written promises to pay that are requested by an employer via a contract, often in the JCT format but also in the NEC contracts. The surety (Guarantor) is providing a guarantee to the principal so as to reassure them that the contractor will fulfil their obligations.

Bonds while they can offered by Insurance Companies and Banks are not actually Insurance Products and as such are not insuring any risk but these large financial institutions are deemed suitable guarantors should the contractor fail by default or insolvency to fulfil their contractual obligations and these companies often only issue Bonds as a supplementary offering not their primary business operation.

Surety Bonds and Guarantees offer Surety Products from specialist Surety Providers, these markets are leaders in the field of Suretyship and their understanding, experience and knowledge in this area is unsurpassed.

Trusted 5* Provider - just some of our many happy customers

Surety Bonds and Guarantees

Surety Bonds and Guarantees work with a vast range of clients from Main Contractors, Tier 1,2 & 3 Sub Contractors, Councils, Independant House Builders and Developers to support any requirement they may have.

We are able to offer any type of Surety Bond, the most common are detailed on our site but our markets are able to consider any requirement you may have so please call one of our team today.

Call now to speak to one of our specialist Bond Brokers – 02476 017646

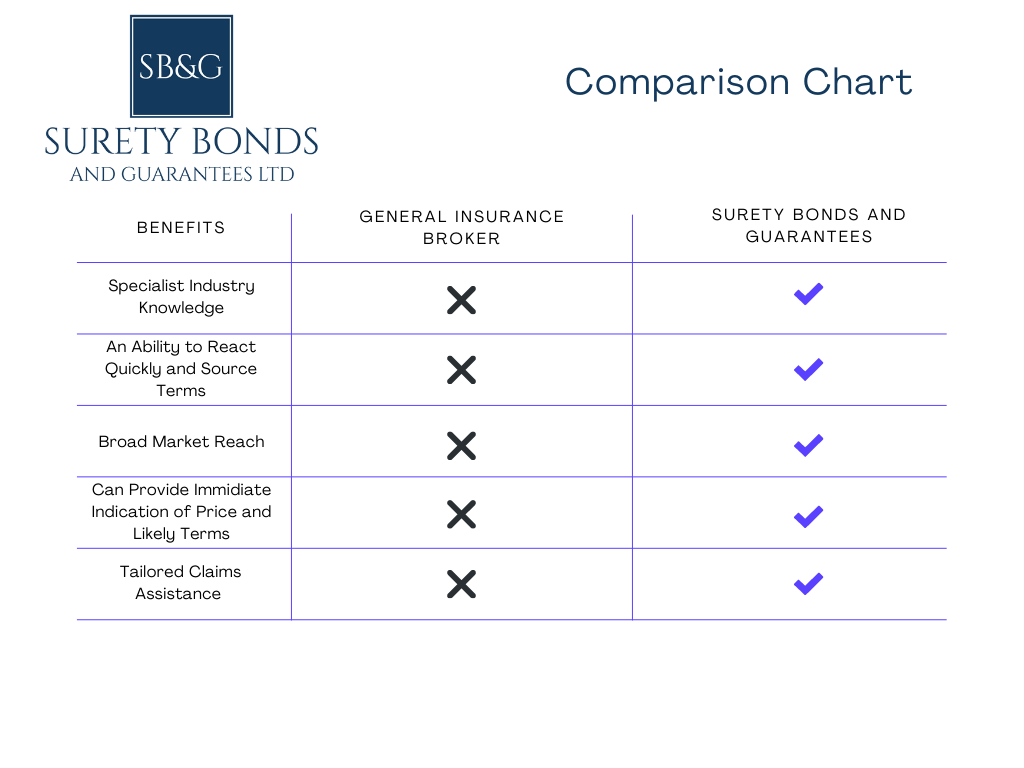

Why You Should Use A Specialist Surety Broker